child tax credit september 2020

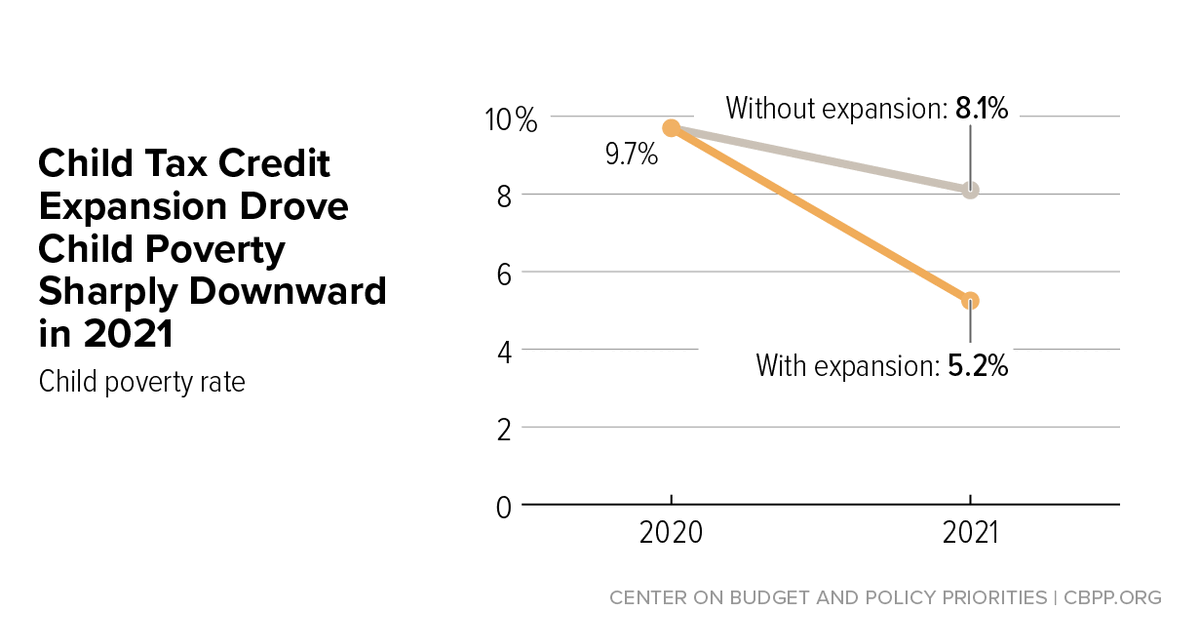

Making a new claim for Child Tax Credit. Census Bureau data released on September 13 the US child poverty declined 46 from 97 in 2020 to 52 in.

Kandit News Group First Batch Of Child Tax Credit Payments Processed Facebook

Child tax credit september 2020.

. The Child Tax Credit provides money to support American families. Child Tax Credit overall decreased poverty. The IRS has set these maximum table limits you can get for the tax years 2022 and 2023.

So In July I called to unenroll from it and the lady said my husband and I werent eligible to recive it but that she would put it that I called to unenroll but last week I recived a. Your child tax credit payments will phase out by 50 for every 1000 of income over those threshold amounts according to joanna powell. Child Tax Credit Update.

The amount you can get depends on how many children youve got and whether youre. Wait 5 working days from the payment date to contact us. The Federal Reserve published a survey on CTC.

The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children. September 20 2022. September 17 2021.

December 13 2022 Havent received your payment. 6728 with three or more qualifying children. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

Filed a 2019 or 2020 tax return and. IR-2021-188 September 15 2021. 6 min read.

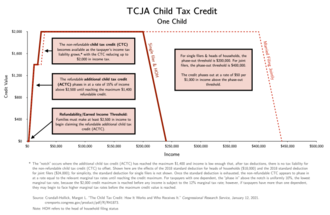

1200 sent in April 2020. It is a partially refundable tax credit if you had earned income of at least. If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2025 in 2017 and earlier Tax Years.

Millions of families across the US will be receiving their third. This is up from 16480 in 2021-22. John Belfiore a father of.

You and your spouse or common-law partner must file your 2019 and 2020 tax returns to get all four payments. The monthly child tax credit payments of 500 along with the pandemic unemployment benefits were helping keep his family of four afloat. Illinois 183 billion relief package includes income and property tax rebates that should be going out through November.

The federal tax filing deadline for individuals has been extended to May 17 2021. If you earn more than. For additional questions and.

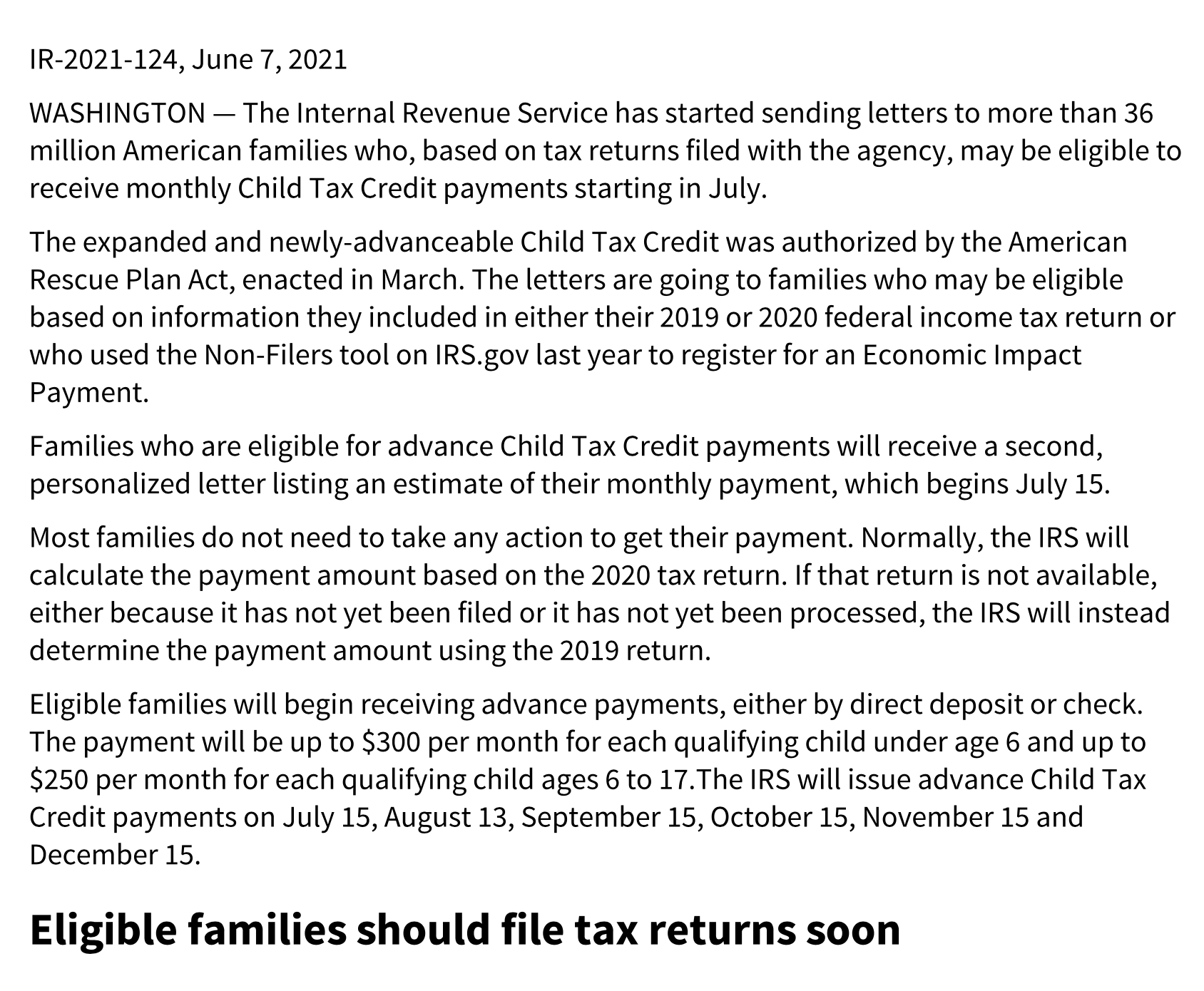

For more information go to CCB young child supplement. Who is Eligible. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have.

Have been a US. 5980 with two qualifying children. Child Tax Credit CTC This credit is for individuals who claim a child as a dependent if the child meets additional conditions described later.

Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid. Through the 2021 Enhanced Child Tax Credit families were able to receive 3600 for children under 6 years of age and up to 3000 for children between ages 6 to 17.

Already claiming Child Tax Credit. A portal to update bank details and facilitate payments. Enhanced child tax credit.

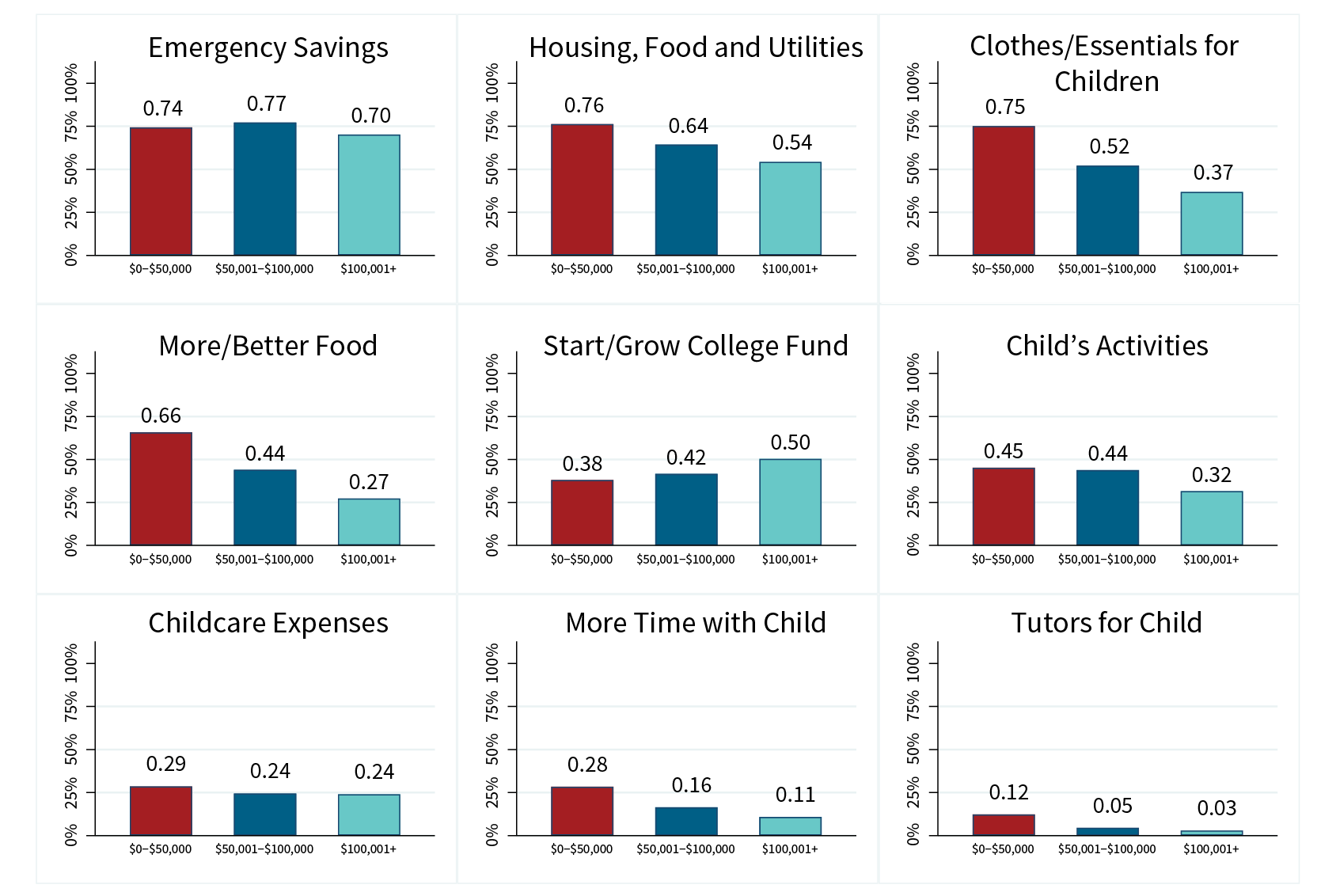

Individuals who earned less than 200000 in. In May The Federal Reserve released a survey claiming Parents who received monthly child tax credit payments most. It is in addition to the credit for child and.

To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022 -23 tax year. This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now.

Ens of millions of people in the United States will have their monthly Child Tax. Quarterly estimated tax payments are still due on April 15 2021.

Child Tax Credit United States Wikipedia

Advanced Child Tax Credit Payments How To Opt Out Bonus Accounting Youtube

Missing September Child Tax Credit Payments Some Parents Have Yet To Receive The Funds Cnn Politics

Biden Administration Reups Child Tax Credit Portal Politico

Biden S Child Tax Credit Plan Points To Progressive Agenda

Child Tax Credit 2021 When Is Deadline To Opt Out From The September Payment As Usa

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Policymakers Should Expand Child Tax Credit In Year End Legislation To Fight Child Poverty Center On Budget And Policy Priorities

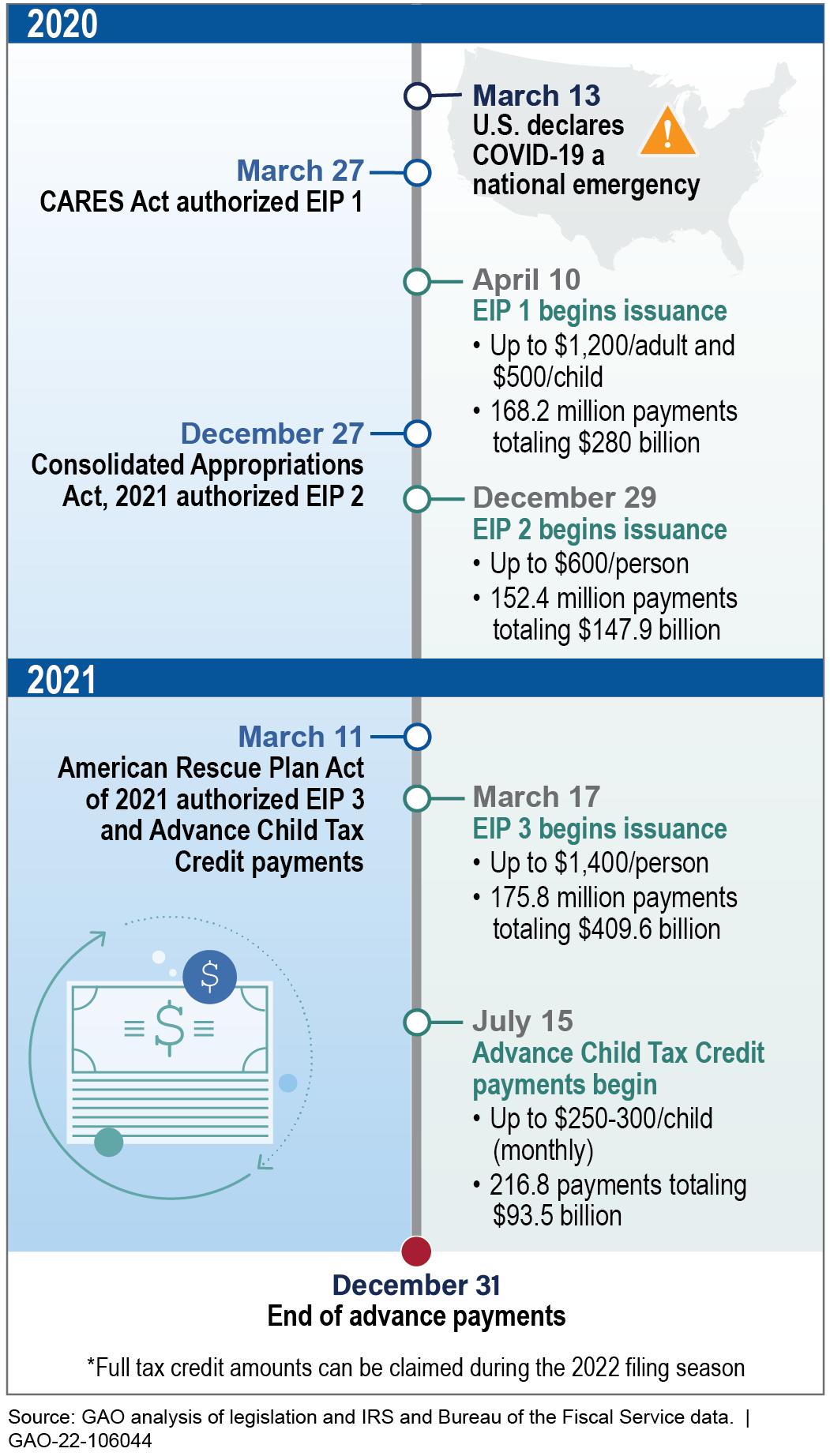

Stimulus Checks Direct Payments To Individuals During The Covid 19 Pandemic U S Gao

Housing Neighborhood Revitalization Resolutions Of Support For Tax Credit Developments

The Covid 19 Pandemic Underscored The Child Tax Credit S Power To Alleviate Family Poverty Urban Institute

Child Tax Credit Update Third Monthly Payment On September 15 Marca

The Child Tax Credit Is Keeping Families Afloat About Saverlife

Deadline To Opt Out Of September Child Tax Credit Payment Is Monday Here S How To Cancel It Fingerlakes1 Com

Irs September Child Tax Credits On The Way For 35 Million Families Future Payment Dates Announced Whnt Com

The New Child Tax Credit Does More Than Just Cut Poverty

The American Families Plan Too Many Tax Credits For Children

Irs Sending Letters To More Than 36 Million Families Who May Qualify For Monthly Child Tax Credits Payments Started July 15 Children Youth News Coconino Coalition For Children Youth

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News